13 Jul 2022

Media:

Lion Rock Daily

Wen Wei Po

Swire Properties expected to maintain stable revenue in second half of 2022

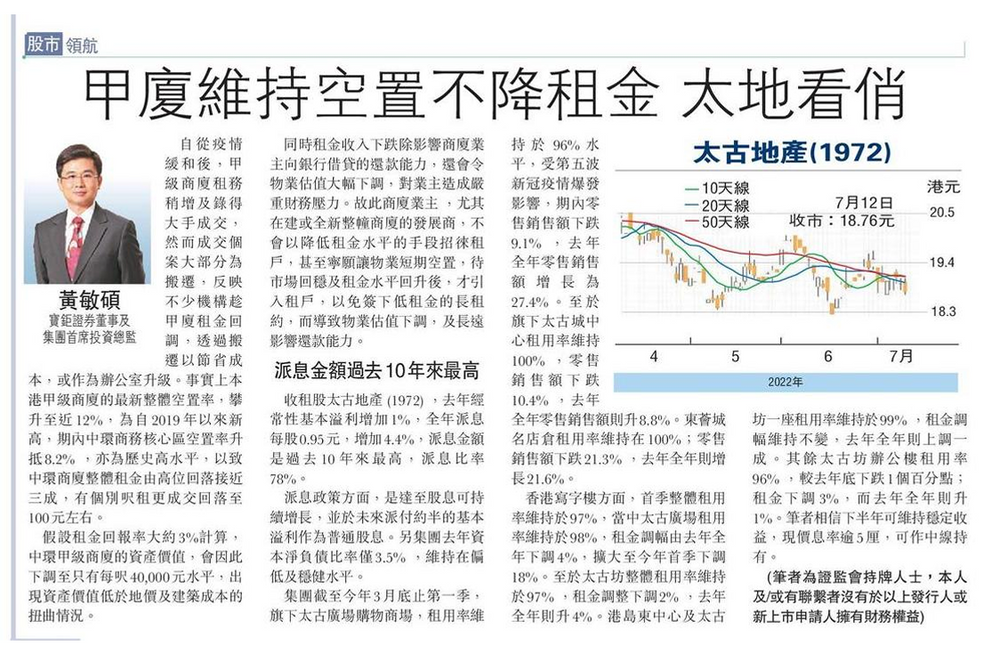

Stock commentator Michael Wong recommended Swire Properties as a stock pick for a solid mid-term investment. He expects the Company to maintain stable revenue in the second half. With 1% growth in recurring profit, Swire Properties declared a dividend of HKD0.95 per share last year – the highest in the past decade – with a payout ratio of 78%. The Company's gearing ratio remained at a relatively low and healthy level of 3.5%.

He noted that occupancy of the Company's office and mall portfolios remained high. For instance, both Cityplaza and Citygate Outlets remained at 100%, and the overall occupancy of Taikoo Place remained at 97%. He predicts that the Company will continue to maintain stable revenues in the second half of 2022.

Media:

Lion Rock Daily

Wen Wei Po