25 Jan 2022

Media:

Hong Kong Economic Times

Swire Properties maintains steady dividend payout over eight years

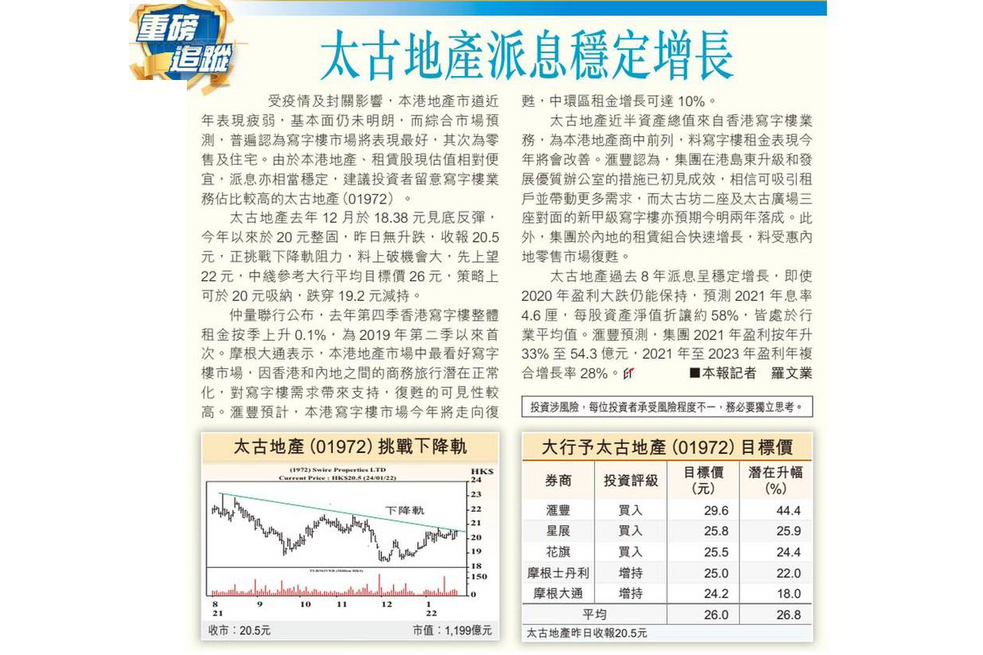

A stock commentator said that Swire Properties has delivered sustainable growth in its dividend payout over the past eight years, even when the Company's business was under pressure in 2020, and is expected to maintain dividend growth going forward. HSBC forecasts that the Company will have a 33% year-on-year increase in earnings to HKD5.43 billion in 2021. The Company's dividend yield is forecast at 4.6% in 2021 and the discount to net asset value per share will be approximately 58%, in line with the industry average.

HSBC believes that Swire Properties' initiatives to upgrade and develop premium office space in Island East are starting to bear fruit, attracting more tenants and driving further demand. As the office market is expected to be the strongest performer in Hong Kong's property sector, investors are advised to pay attention to Swire Properties, which has a lot of office tower assets in Hong Kong. Two new Grade-A office towers are expected to be completed in the next two years, further increasing its office floor area. The Company's leasing portfolio in the Chinese Mainland has also been growing rapidly and should benefit from the recovery of the Chinese Mainland retail market.

Media:

Hong Kong Economic Times

HKET

25 Jan 2022