Media Coverage

9 Mar 2023

Media:

Commercial Real Estate Observation (WeChat)

Hong Kong Economic Journal

Hong Kong Economic Times

Ming Pao Daily News

National Business Daily

SCMP

Sing Tao Daily

The Standard

澎湃新闻网

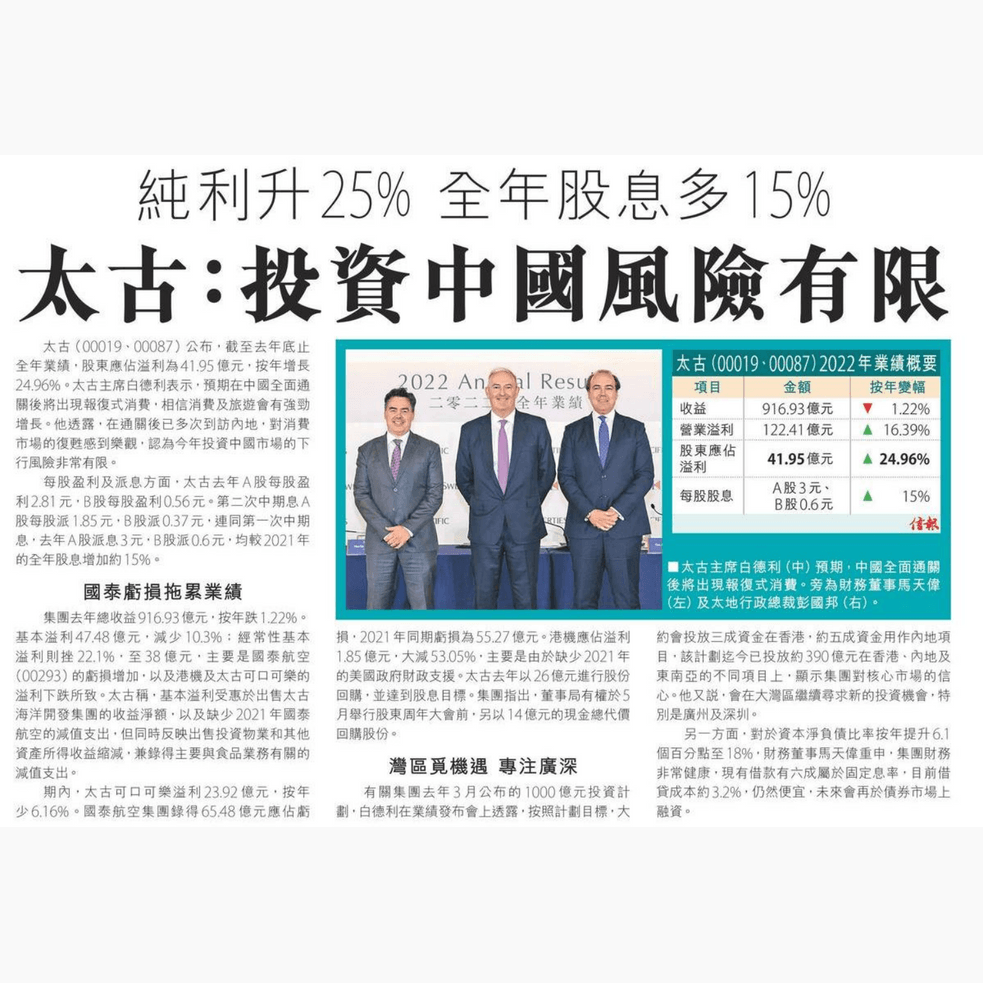

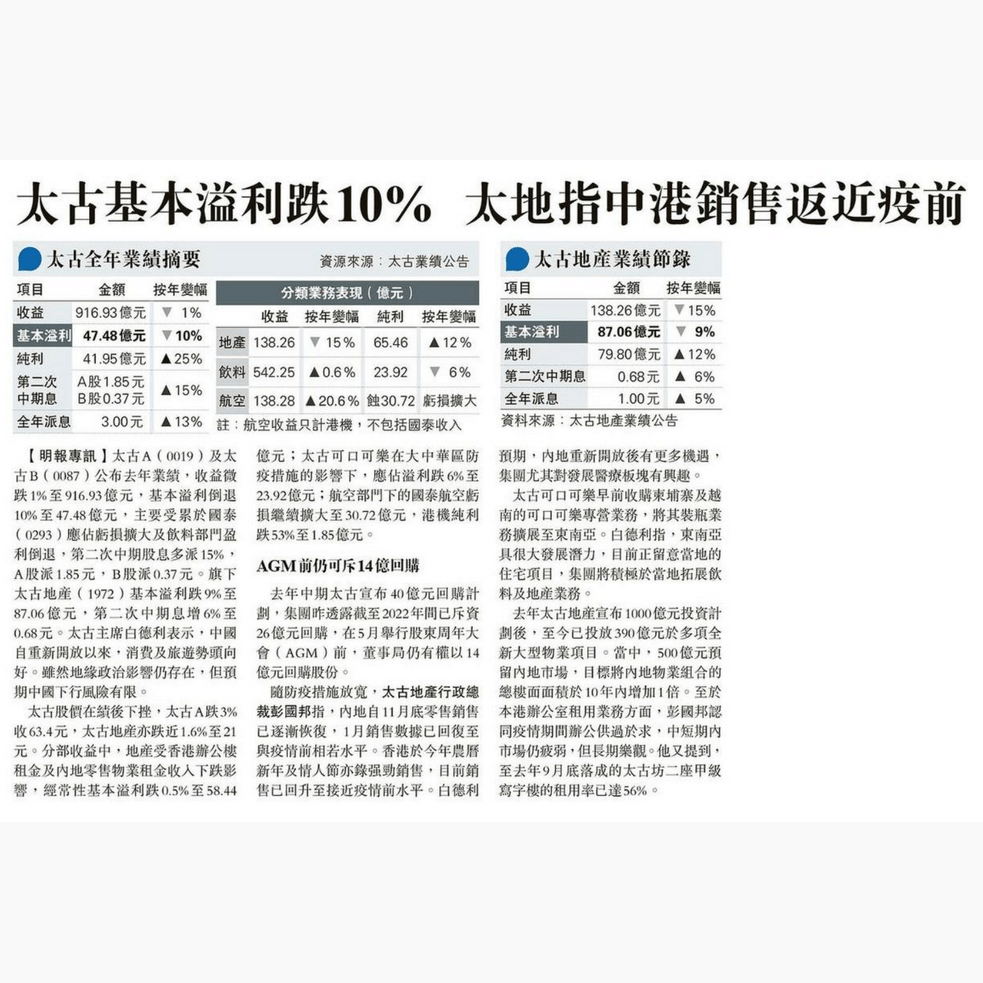

Swire Properties raises dividends for 2022, focusing on retail recovery

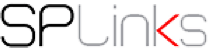

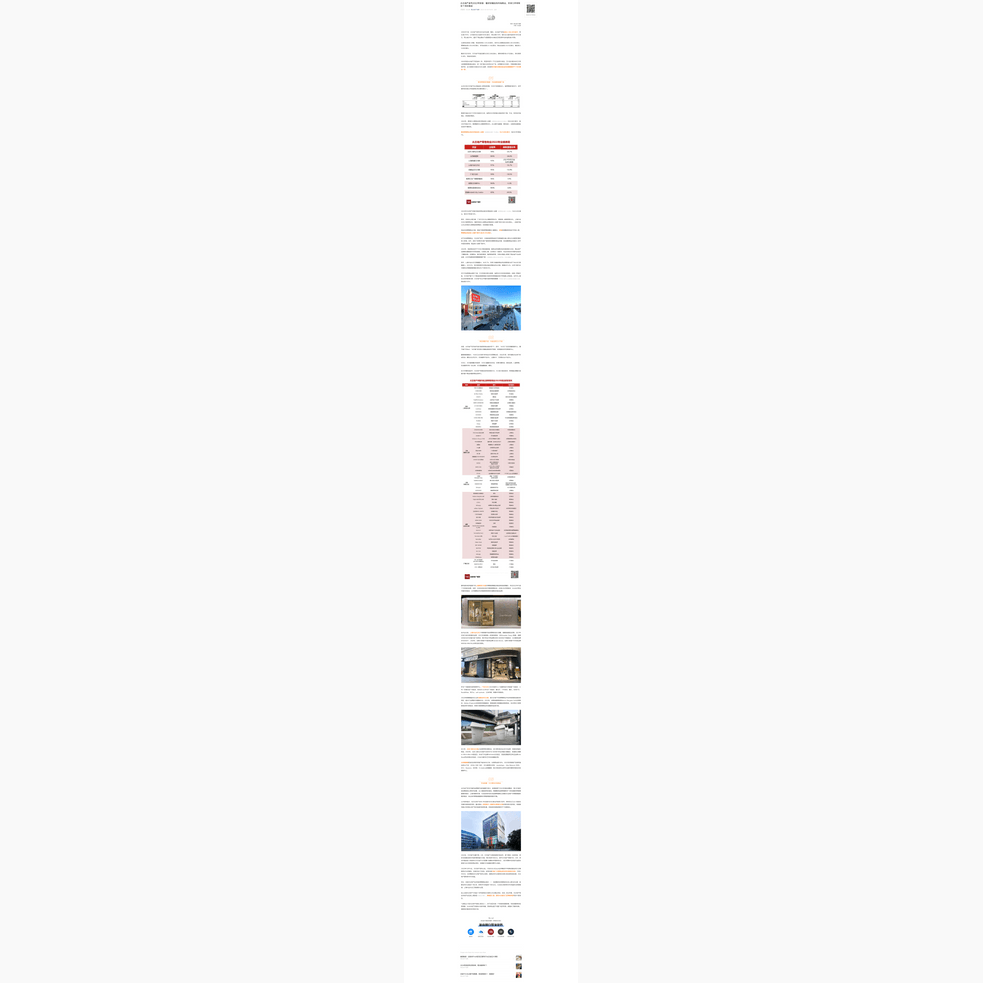

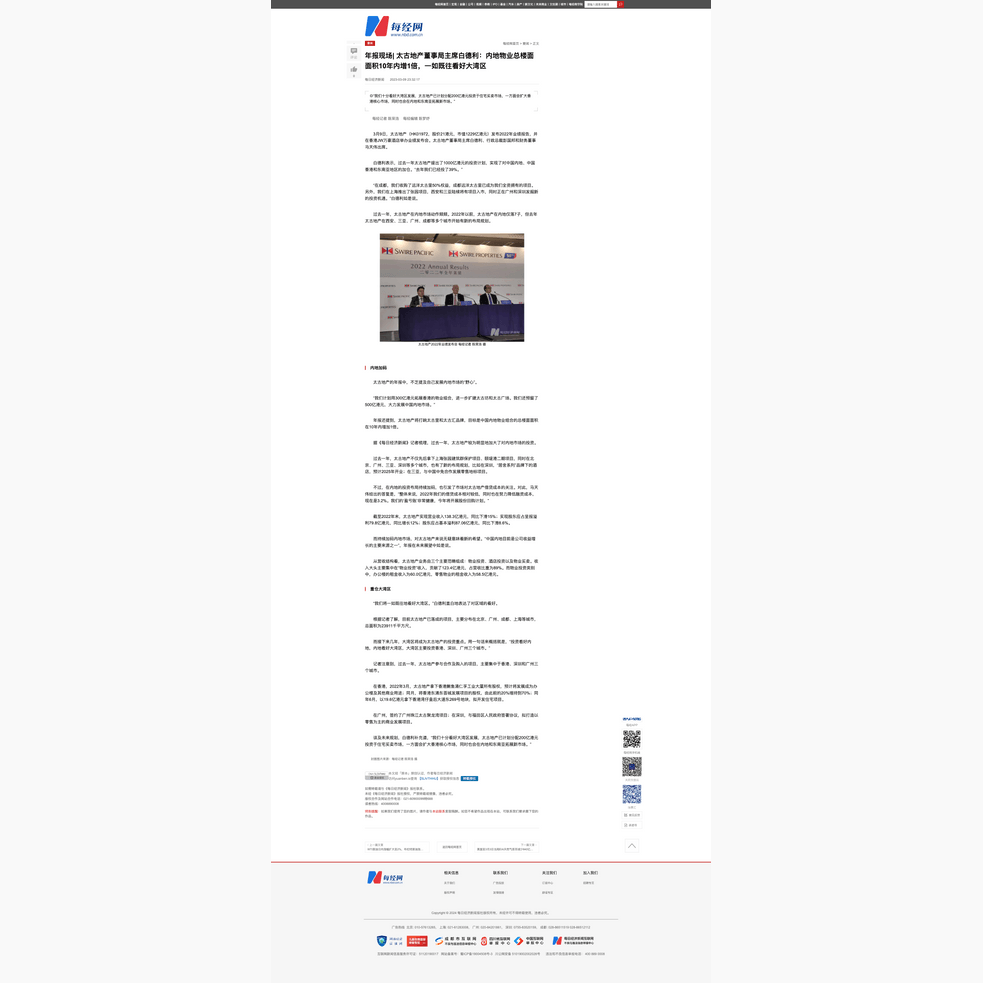

Swire Properties reported a 9% decrease in underlying profit and a 12% increase in the reported profit attributable to shareholders for 2022. Despite facing challenging operating conditions, the Company declared a final dividend of HKD0.68, resulting in a full-year dividend of HKD1.00 per share, which represents a 5% increase from 2021. Some media sources have cited this as indicative of sustainable dividend growth, with approximately half of the underlying profit being paid out in ordinary dividends over time. Chief Executive Tim Blackburn said that footfall in malls in both Hong Kong and the Chinese Mainland has nearly returned to pre-pandemic levels. However, rents in the office market are likely to experience some downward pressure in the short to medium term.

Chairman Guy Bradley noted the emergence of revenge spending and travelling after the Chinese Mainland reopened its borders. Yet the downside risks of investing in the Chinese Mainland should be limited, which is encouraging for future growth and acquisition opportunities.

Swire Properties has already committed 39% of its HKD100 billion investment plan, of which HKD50 billion has been designated to double the Company’s gross floor area in the Chinese Mainland over the next decade. Additionally, the newly launched Two Taikoo Place has secured a pre-leasing commitment of over 56%.

Media:

Commercial Real Estate Observation (WeChat)

Hong Kong Economic Journal

Hong Kong Economic Times

Ming Pao Daily News

National Business Daily

SCMP

Sing Tao Daily

The Standard

澎湃新闻网